alliancebernstein multi asset

Die Investmentkapazitäten umfassen diverse. AllianceBernstein Emerging Markets Multi-Asset Portfolio Monthly UpdateFebruary 2014 Seeking Equity-Like Returns After suffering their worst January performance since 2009 equity markets in the developing world rebounded in February as investors found reasons to be optimistic despite mixed macro news The EMMA Strategy up 05.

Ab Fondsmanager Morgan Harting So Haben Sich Die Emerging Markets Im Letzten Jahrzehnt Verandert

Das Anliegen von AB ist es den Kunden durch innovative Ansätze dabei zu helfen ihr Vermögen zu schützen und zu mehren.

. Insights Across All Markets. This multi-asset index has been developed exclusively for AIGs Power Select Index Annuities by AllianceBernstein AB and will be distributed primarily through Market Synergy Group MSG. AB today announced that preliminary assets under management decreased to 735 billion during March 2022 from 740 billion at the end of February.

The Strategys Prospectus and Statement of Additional Information both dated March 8 2010 are incorporated by reference into. Februar 2017 als Global Research Director für das Multi-Asset Solutions Team tätig ist. Multi-Asset Multi-Asset Focus on Client Outcomes.

Oustry and Attaripour will join ABs Multi-Asset Solutions team and will be based in ABs London office. It can also generate attractive levels of income. MULTI-ASSET JUN 800 300622 Overall Morningstar Rating Class A USD Shares QQQQ AB Emerging Markets Multi-Asset Portfolio Strategy Seeks to maximize total return by.

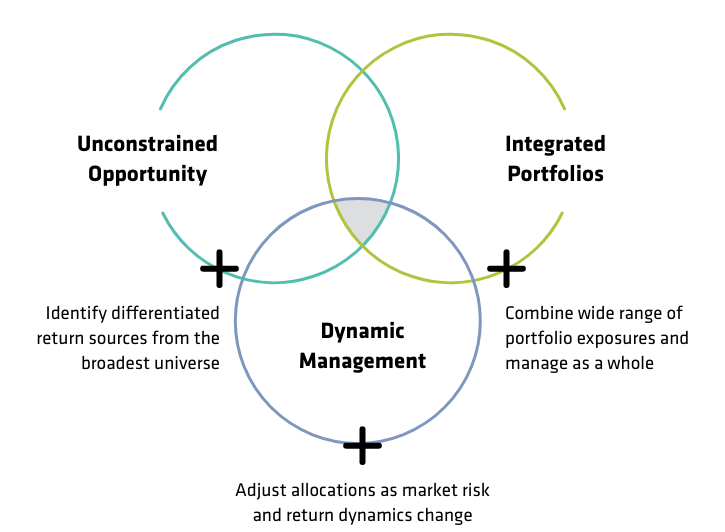

The 07 decrease was due to market depreciation and firm. This multi-asset index has been developed exclusively for AIGs Power Select Index Annuities by AllianceBernstein AB and will be distributed primarily through Market Synergy Group MSG. Multi-Asset We harness our firms strength across asset classes and markets applying an unconstrained approach that results in holistic integrated solutions tailored to clients needs.

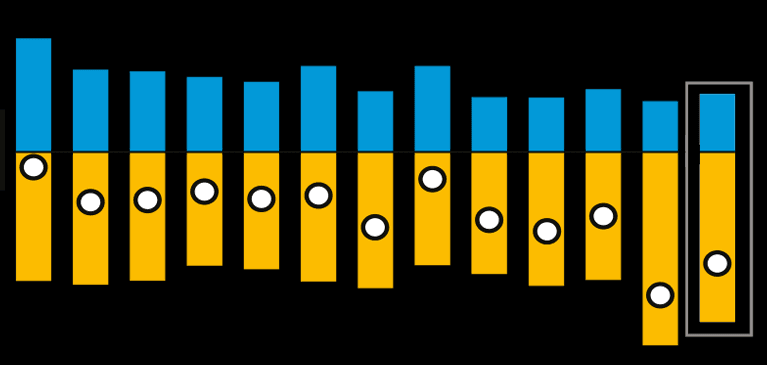

Capabilities A Proven Track Record of Leveraging Four Key Capabilities Strategic Asset Allocation 50 years experience in providing Multi- Asset Solutions Leader in custom retirement with 15 years of retirement glide path design Tactical Asset Allocation. ROLLING PERFORMANCE Growth of Investment Daily Statistics FEES EXPENSES Investment risk Fund Literature Prior to 11 December 2014 the Portfolio was named AllianceBernstein-Global Conservative Portfolio. Philosophy It takes a thoughtful unconstrained approach to design innovative multi-asset solutions that expand on the traditional and exploit the new.

A dynamically managed EM multi-asset portfolio may provide returns comparable to equities with much lower volatility and shallower drawdowns in our view. Before you invest you may want to review the Strategys Prospectus which contains more information about the Strategy and its risks. Damit reagiert AB auf eine gesteigerte Nachfrage bezüglich Multi-Asset-Produkte.

AllianceBernstein Fund - AB Multi Asset 2022 I Portfolio S1 EUR Acc Add to watchlist LU1434137052EUR Actions Price EUR 1944 Todays Change 000 000 1 Year change -061 Data delayed at. Multi-Asset We harness our firms strength across asset classes and markets applying an unconstrained approach that results in holistic integrated solutions tailored to clients needs. Multi-Asset Wir nutzen unsere hohe Research- und Investment-Kompetenz in allen Anlageklassen und Märkten weltweit um mit robusten Multi-Asset-Portfolios aus traditionellen und nicht traditionellen Ertragsquellen die Ziele unserer Kunden zu erreichen.

AllianceBernstein National Municipal Income NII of 016. Also at this time the Portfolios strategy changed. Philosophy It takes a thoughtful unconstrained approach to design innovative multi-asset solutions that expand on the traditional and exploit the new.

Philosophy It takes a thoughtful unconstrained approach to design innovative multi-asset solutions that expand on the traditional and exploit the new. But since late 2021 theyve been much more volatile as markets digest central banks transitions toward tighter monetary policy. Multi-Asset We harness our firms strength across asset classes and markets applying an unconstrained approach that results in holistic integrated solutions tailored to clients needs.

Der US-amerikanische Asset Manager AllianceBernstein AB gab vor wenigen Tagen bekannt dass Jess Gaspar ab dem 24. Wie lässt sich tragfähiges Wachstum in volatilen. AB Holding NYSE.

NASHVILLE Tenn April 11 2022 PRNewswire -- AllianceBernstein LP. Interest RatesInterest RatesBond MarketBond MarketCurrencyCurrencyEquity MarketEquity. AllianceBernstein fund net assets 373215526.

AB and AllianceBernstein Holding LP. AllianceBernstein ist eine weltweit führende Fondsgesellschaft mit einer breiten Palette von Anlagelösungen für Institutionen und Privatanleger. All data prior to 11 December 2014 relates to the Global Conservative Portfolio.

François Oustry and Sahar Attaripour co-founders of Suzugia have joined AllianceBernstein. AB Developed Markets Multi-Asset Income Portfolio Portfolio Objective and Strategy The Portfolio seeks income generation and long-term growth of capital by obtaining exposure primarily to the equity and debt securities of developed market issuers. 02172022 0348pm EDT For most of the past decade government bonds have contributed positive returns and a note of stability to multi-asset portfolios.

Dynamically adjusting exposure to emerging markets by investing across asset classes which include equities fixed income and currencies Building an unconstrained portfolio to maximize total. AllianceBernstein AB conducted an acqui-hire by hiring the Co-Founders of Suzugia Limited a company engaged in natural language processing NLP. The AB All Market Index may help consumers in changing markets by balancing growth equity and defensive fixed income assets.

With over 50 years of multi-asset management experience AllianceBernsteins AB 56 multi-asset investment professionals and 215 cross-asset research analysts across the globe are committed to providing holistic multi-asset investment solutions for clients. AllianceBernstein Multi-Asset Inflation Strategy.

Ab Emerging Markets Multi Asset

Newsletter Marz 2021 In 2021 Drahtseil Geldanlage Fangnetz

Wachstumsorientierte Investitionen In Einer Nachlassenden Konjunktur Ab

Multi Asset Allocation Quant Signals Shine Through Cloudy Markets Ab

Vanguard Ernennt Chef Fur Multi Asset Solutions In Europa Intelligent Investors

On The Desk What It Takes To Build A Multi Asset Trading Team The Desk Fixed Income Trading

Alliancebernstein Ab Brighttalk

A Virtual Assistant Called Abbie Is Picking The Best Bonds For Traders To Buy Or Sell Wall Street Investing Algorithm

Vorsprung Durch Vielfalt Diversifikation Und Diversitat Als Mehrwert Fur Produkte Und Unternehmen

Assetallocationforum Multi Asset Investing 2022 Wirksame Diversifikation Als Mission Impossible

Higher Yields Expand Income Options For Multi Asset Investors Ab

Neue Investmentboutique Geht An Den Start

Higher Yields Expand Income Options For Multi Asset Investors Ab

Comments

Post a Comment